Avoiding Common Pitfalls in Demat Account Setup for NRIs and Foreign Entities

The process of setting up a Demat account for NRIs (Non-Resident Indians) and foreign entities is an essential step for those looking to invest in Indian stocks, bonds, and other securities. However, it's not as simple as just opening a local Demat account. There are several regulatory, documentation, and taxation nuances that can cause complications if not understood properly.

In this article, we will dive deep into the common pitfalls NRIs and foreign entities face when setting up a Demat account and how you can avoid them. We'll cover everything from understanding RBI guidelines to choosing the correct account type, and even navigating the tax and currency conversion issues.

What is a Demat Account for NRIs and Foreign Entities?

A Demat account, short for "dematerialized account," is an account that holds securities in electronic form, instead of physical certificates. These accounts simplify the process of buying, selling, and managing securities for investors. For NRIs and foreign entities, opening a Demat account in India is crucial to participate in the Indian stock market and other investment opportunities.

However, the process for NRIs and foreign entities differs slightly from that of resident Indians. There are more regulatory checks, specific documentation requirements, and account types to consider. This is primarily due to foreign exchange regulations and taxation rules that apply to foreign investors. Let's explore some of these in more detail and highlight the challenges that can arise during the account setup process.

Common Pitfalls in Setting Up a Demat Account

Setting up a Demat account as an NRI or a foreign entity involves several critical steps. Missing even one of them can lead to delays, complications, or non-compliance issues. Below are the most common pitfalls:

Lack of Knowledge About RBI Regulations

The Reserve Bank of India (RBI) plays a central role in governing financial transactions for NRIs and foreign entities, especially concerning foreign investments. Often, investors are unaware of the RBI’s strict regulations regarding foreign investment in India, which can result in costly mistakes.

The Foreign Exchange Management Act (FEMA) regulates how NRIs can invest in India, and failing to comply with these regulations can result in penalties or even the suspension of your account. Many NRIs and foreign entities fail to thoroughly understand these regulations, leading to roadblocks in their investment journey.

Choosing the Wrong Type of Demat Account

NRIs and foreign entities must choose the right type of Demat account based on their repatriation needs. The two main types of accounts for NRIs are:

- Repatriable Demat Account (NRE Account): This allows the transfer of funds abroad. However, it has certain restrictions on investments.

- Non-Repatriable Demat Account (NRO Account): This account does not allow the transfer of funds to foreign countries but provides more flexibility in terms of investments.

One common pitfall is choosing the wrong type of account. Many NRIs who intend to repatriate funds later discover they are locked into an NRO account, making it difficult to transfer their funds abroad. Similarly, a foreign entity might struggle with documentation if the account type isn't chosen correctly from the start.

Incorrect Documentation

Documentation is a significant challenge for NRIs and foreign entities when opening a Demat account. While resident Indians can typically open a Demat account with basic KYC (Know Your Customer) documents like a PAN card and Aadhaar, NRIs and foreign entities have a much longer list. Some documents required include:

- Passport and visa copies.

- Proof of overseas address.

- PIS (Portfolio Investment Scheme) approval from the RBI.

- Foreign address proof for entities.

Failing to provide the correct documents can delay the account opening process or result in the application being rejected altogether.

Inadequate Understanding of Tax Implications

Taxes are another tricky aspect when it comes to investments through a Demat account for NRIs and foreign entities. In India, there are specific tax rules for foreign investors, including capital gains tax, dividend tax, and tax deduction at source (TDS).

Without a solid understanding of these tax implications, foreign investors might find themselves facing hefty fines or, worse, a legal dispute with the Indian authorities. This is especially true for NRIs who may not be aware of Double Taxation Avoidance Agreements (DTAA) that exist between India and their country of residence, which could provide tax relief.

Currency Conversion Issues

Since NRIs and foreign entities deal in foreign currencies, the need for currency conversion arises when investing in India. A common pitfall is not accounting for conversion fees and exchange rate fluctuations, which can significantly impact the actual value of investments.

Additionally, these conversions may involve delays, and without proper planning, investors might find themselves losing value in their transactions. This is a more significant issue for foreign entities dealing in large volumes of capital that require frequent conversion.

How to Avoid These Pitfalls

Now that we've covered the common pitfalls in setting up a Demat account, let's explore how to avoid them.

Stay Updated on RBI Guidelines

The first and foremost step to avoid potential issues is to familiarize yourself with the RBI regulations regarding foreign investments. The RBI updates its rules periodically, and staying up to date ensures compliance and a smooth account setup process. Engage with a qualified financial advisor who is well-versed in the Foreign Exchange Management Act (FEMA) to help you navigate these waters.

Select the Right Demat Account Type

As an NRI, you have the option to choose between repatriable (NRE) and non-repatriable (NRO) Demat accounts. Foreign entities also need to determine the right account structure based on their operational requirements. Here's a quick breakdown:

-

NRE Demat Account (Repatriable): If you want to repatriate your funds to your foreign bank account, ensure that you choose an NRE account. This allows for smooth fund transfers outside India.

-

NRO Demat Account (Non-Repatriable): Choose an NRO account if you are okay with the idea that your earnings will remain in India. It provides more flexibility for investments.

If you are unsure about which Demat account type is best for your needs, or need assistance with the full setup, services like Accounti.ai's Demat Account services offer complete guidance and support to streamline the process for both NRIs and foreign entities.

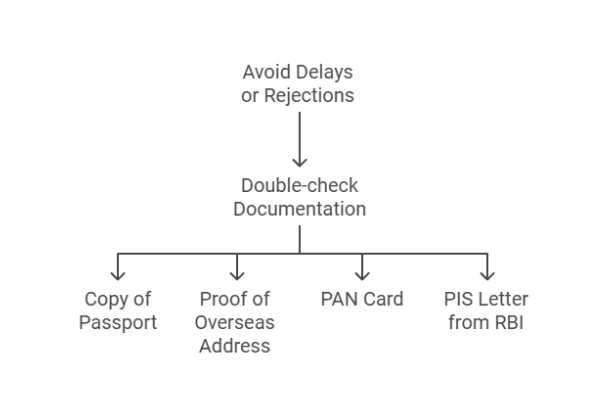

Ensure Proper Documentation

To avoid delays or rejections, double-check your documentation. Below is a checklist of the primary documents you will need as an NRI:

- Copy of your passport (mandatory).

- Proof of overseas address.

- PAN card (if investing in Indian securities).

- PIS letter from the RBI.

For foreign entities, the requirements may be more detailed, including:

- Company incorporation documents.

- Proof of registered address.

- Authorized signatory list.

Ensure you work closely with the financial institution where you're opening your Demat account to confirm the required documentation and avoid missteps.

Consult Tax Experts

Given the complexities surrounding taxes for NRIs and foreign entities, it's advisable to consult a tax expert who specializes in NRI taxation. This will help you understand how capital gains are taxed, what you can do to take advantage of DTAA agreements, and how to minimize your overall tax liability.

Additionally, keep track of any Tax Deducted at Source (TDS) requirements to avoid unnecessary penalties or losses.

Be Aware of Currency Conversion Rates and Fees

To mitigate the issues of currency conversion, it's crucial to plan for exchange rate fluctuations and conversion fees. If you're dealing with large transactions, consider using financial tools like forward contracts or currency hedging to lock in a favorable exchange rate and protect your investments from sudden market shifts.

Consulting with a financial advisor who understands both your domestic currency and the Indian rupee will give you an upper hand in managing your currency risks effectively.

Comparison of Different Types of NRI Demat Accounts

Here’s a simple comparison between NRE, NRO, and Foreign Entity Demat accounts to help you understand the differences more clearly:

|

Account Type |

Repatriation of Funds |

Currency |

Tax Implications |

Investment Options |

Ideal For |

|

NRE Demat Account |

Allowed |

INR (Indian Rupee) |

TDS applies |

Stocks, Mutual Funds, Bonds |

NRIs wanting to repatriate funds |

|

NRO Demat Account |

Not Allowed |

INR |

Higher TDS rates |

All asset classes available to resident Indians |

NRIs willing to keep funds in India |

|

Foreign Entity Demat Account |

Allowed |

Multiple Currencies (requires conversion) |

Subject to DTAA |

Stocks, Bonds, Mutual Funds, Government securities |

Foreign entities investing in India |

Conclusion

Opening a Demat account as an NRI or a foreign entity can be a powerful way to tap into the wealth of investment opportunities India offers. However, the process can be fraught with pitfalls if you're not careful. From misunderstanding RBI regulations to submitting incorrect documentation, the hurdles can seem numerous—but they’re not insurmountable.

The key is to stay informed, choose the right type of account, and consult experts when necessary, particularly when it comes to taxation and currency conversion. With the right knowledge and preparation, you can avoid the common pitfalls that many NRIs and foreign entities fall into, ensuring a smooth and profitable investment experience.

Rohit Kapoor

Rohit Kapoor